Easy News: Government announces National Insurance increase to provide more funding for social care and NHS

Easy News: Government announces National Insurance increase to provide more funding for social care and NHS

-

-

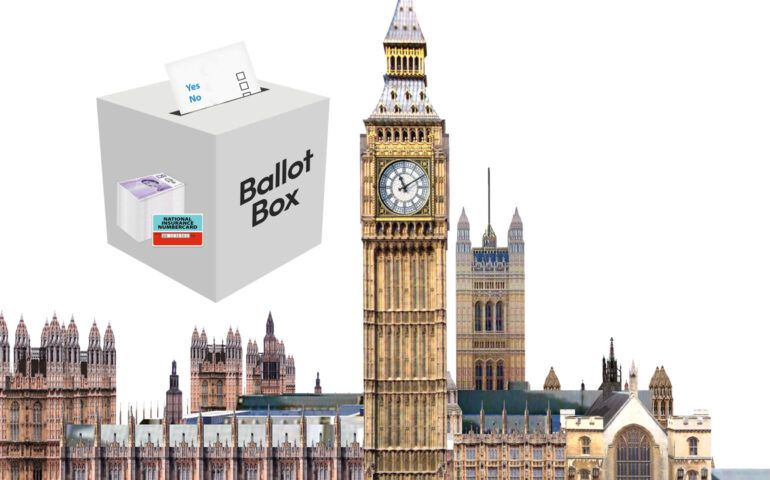

To try and help the NHS and social care system cope better, the UK Government has announced that National Insurance will be increased by 1.25% from April 2022.

-

National Insurance is a form of tax. It is paid by most people in work (Employee NI) and also by the companies that they work for (Employer NI).

-

There was a vote in Parliament on September 8. The Government won by 319 votes to 248. There were 83 MPs that did not vote, so if these MPs had voted against the bill, the Government would have lost the vote.

-

The majority of Labour MPs voted against the bill, because they believe it is unfair and it taxes poorest people the most.

-

National Insurance is taken from the money you earn at work. The higher someone’s salary is, the smaller the percentage of earnings someone pays.

-

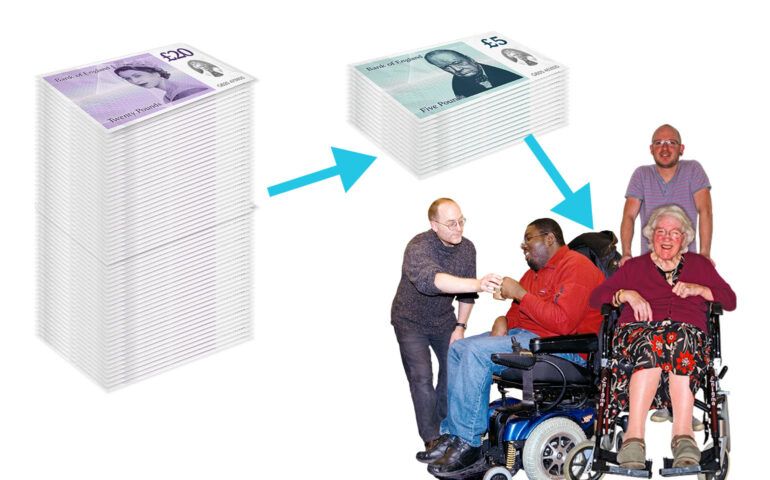

For example, someone earning £20,000 per year will pay £130 more per year which is an increase of 9.6%. Someone else earning £100,000 will pay £1,130 more per year, an increase of just 5.2%.

-

The bill also says that from October 2023, £86,000 is the maximum people in England can pay for care in their lifetime. The rules are different in other parts of the UK.

-

Many MPs from opposing parties believe this is unfair and that it should be a percentage and not a set amount. This is because people with a larger amount of money would not spend as much as people with less.

-

Opposition MPs believe that the bill means that younger and poorer working people are paying for wealthy elderly people to keep their assets.

-

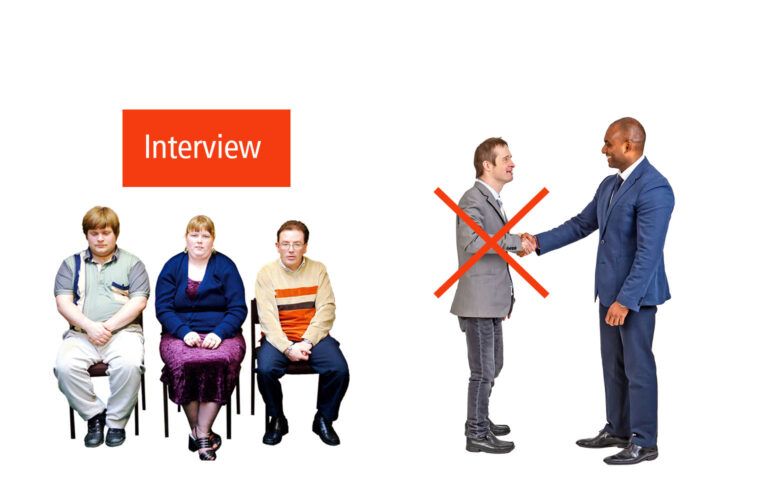

They also say that employers will employ fewer people because of the increases to National Insurance.

-

But the Government said that the bill is “fair and necessary”, with the richest 14% of people contributing 50% of the cost.

-

They also say that the bill will provide more money for the NHS and social care: £12 billion per year for the next three years.

-

Around 15% of this £36 billion, which is about £5.4 billion, will go to providing better social care.

-

The NHS is responsible for people’s general health, whereas the social care sector provides different types of support and care. There is an argument for these two services being better connected or merged together.

-

One major problem with social care is that local councils provide this, but they have had less money to provide services since 2010.

-

Most politicians agree that taxes need to rise to pay for the NHS and Social Care, but they disagree on which taxes to increase and the fairest way to pay for it.

-

Sign up here to receive the latest issue of Easy News delivered direct to your inbox. If you would like to see previous issues of Easy News, contact us.

-